Consumer Journey – Existing User

User who has already registered with Onemoney Account Aggregator

STEP 1 (FIU): The journey starts on the FIU app, where FIU shares a suggestion to Venkatesh Iyer that he is eligible for a business loan.

STEP 2 (FIU): Venkatesh Iyer then selects the type of loan he is applying for in the FIU app. He will then fill in his loan application form. He goes through the list of documents to provide for processing the loan. One of the requirements is to provide the bank statement. On selecting this requirement, he navigates to a screen in which his Onemoney AA ID is pre-populated in the relevant field.

STEP 3 (FIU): In the backend FIU and Onemoney will exchange information to confirm existence of Venkatesh Iyer as a customer. FIU generates a Consent Request.

STEP 4 (Onemoney SDK): Onemoney AA authenticates Venkatesh Iyer – this is a regulatory requirement.

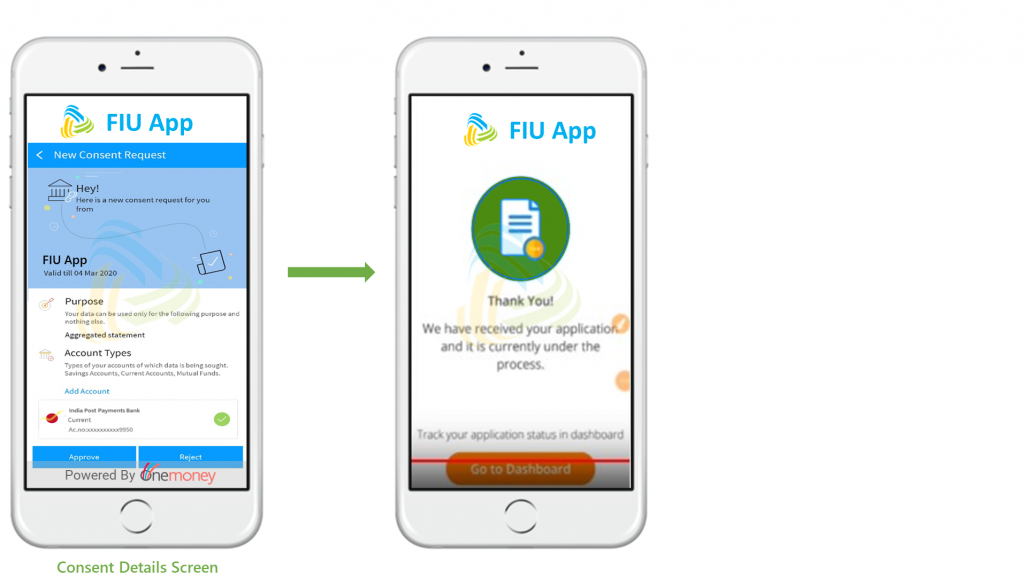

STEP 5 (Onemoney SDK): Venkatesh will be shown the consent request which he may approve. In the backend, Onemoney generates a consent artefact (A machine-readable electronic document that specifies the parameters and scope of data sharing that a consumer consents to in any data sharing transaction) and fetches Venkatesh Iyer’s Bank statement, as an encrypted file, which will be delivered to FIU.

STEP 6 (FIU): On explicit approval of the consent request, the FIU app displays an appropriate confirmation message for the loan process initiation

Given below is the illustration of the user journey.